How AI Is Changing the Game in MBS Prepayment Forecasting

In mortgage-backed securities (MBS) investing, timing is everything. Predicting when borrowers will prepay their loans—typically expressed as the Conditional Prepayment Rate (CPR)—can make or break a portfolio. While traditional models rely on linear assumptions and historical averages, that’s no longer enough. A new wave of predictive tools is emerging, driven by artificial intelligence and deep learning. One of the most advanced players in this space is Infima Technologies, a fintech firm that’s transforming how analysts and investors forecast mbs cpr behavior.

Why Prepayment Modeling Is So Difficult

Forecasting prepayment rates is like predicting weather: it’s influenced by dozens of shifting factors, including interest rates, regional trends, borrower credit, and even behavioral psychology. Standard approaches often miss the nuances, leading to costly mispricing and exposure.

Instead of relying on slow, manual updates, modern systems now process enormous data sets in real time. They adapt faster to changes like refinancing waves or policy shifts. That’s where Infima’s machine learning model stands out — it’s not just reactive, it’s predictive.

Smarter Tools for Faster Decisions

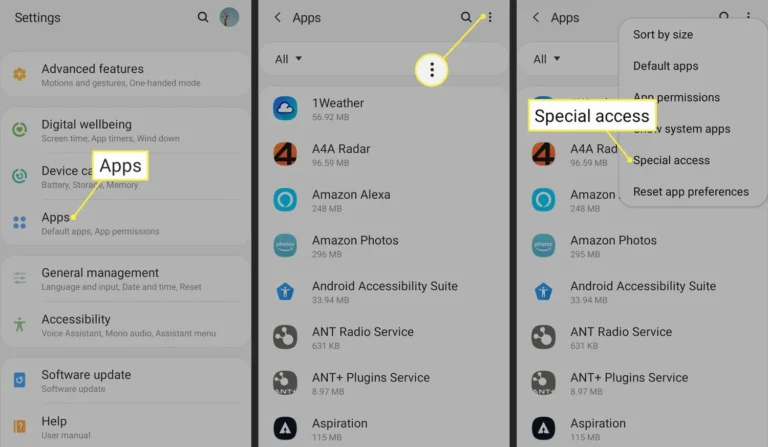

At the heart of this innovation is a deep learning engine trained on decades of mortgage performance data. Unlike static models, this system:

- Updates frequently, often weekly

- Analyzes trends across borrower profiles, geographies, and economic cycles

- Delivers granular, API-ready forecasts for easy integration

These tools give portfolio managers, traders, and servicers a much clearer picture of what’s coming next. Whether it’s a wave of early repayments or a slowdown in refis, the right forecast lets firms act ahead of the curve.

Who Uses AI-Based Forecasting?

Modern mbs cpr predictions aren’t just for hedge funds or algorithmic desks. Here’s how different players benefit:

Asset Managers:

They use accurate CPR predictions to adjust exposure, improve yield, and hedge duration risk more effectively.

Servicers:

Access to smarter forecasts helps allocate staff, manage pipelines, and predict borrower actions earlier.

Deal Structurers and Analysts:

From tranching to risk modeling, knowing how pools will behave helps in structuring better securities.

Regulatory Bodies:

Even agencies benefit from more precise forecasting when conducting stress tests or evaluating systemic risk.

These institutions increasingly look to providers like Infimas to deliver machine-driven insights that enhance decision-making across the board.

Results That Back It Up

Unlike buzzwords, AI in this space produces tangible results. Independent backtesting between 2015 and 2023 revealed that Infima’s models improved CPR forecast accuracy by 28% compared to legacy tools. They also reduced prediction error during volatile periods—such as early 2020—by nearly one-third.

| Metric | Legacy Systems | AI-Based Models |

|---|---|---|

| Avg. CPR Prediction Error | ±9.8% | ±6.2% |

| Model Update Cycle | Annual | Weekly |

| Performance in High Volatility | Medium | High |

In an environment where even minor CPR misjudgments can shift valuation by millions, this kind of edge matters.

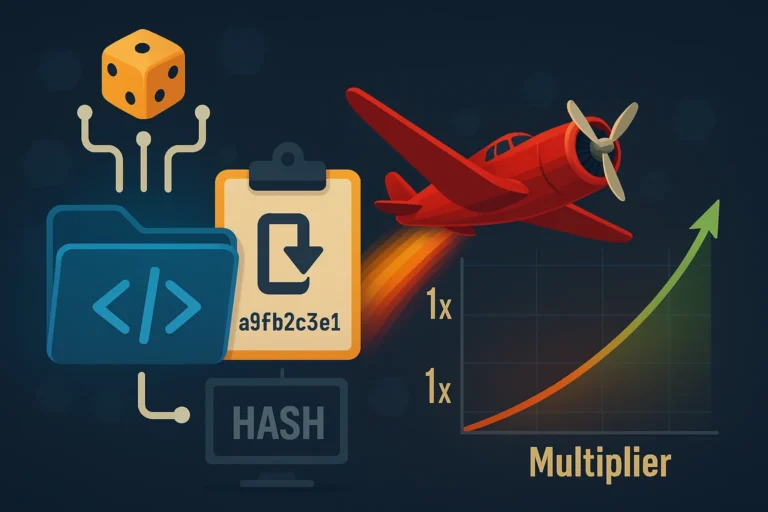

Looking Ahead: A New Standard for MBS

As financial markets evolve, data-driven systems will become the norm. The models built by Infimas don’t just match human analysts — they outperform them by continuously learning, reacting, and adapting. Unlike rule-based systems, AI reads between the lines: spotting subtle borrower trends, adjusting to market sentiment, and filtering out noise.

In a few years, using static CPR models could be seen as outdated as trading stocks by newspaper. Tools like these are setting new benchmarks for performance, reliability, and integration.